Jan 31, · January 30, 509 PM When you receive a form 1099MISC, you are selfemployed and considered as operating a business This is not a business in the common meaning, but that you are in business doing what you do to earn the money reported on the 1099MISCDec 01, · Forms 1099 are information returns that businesses use to report certain payments There are two types of 1099 forms Form 1099MISC and Form 1099NEC Between 19 – , businesses used Form 1099MISC for all 1099 reporting But in ,11// Inst 1099MISC Instructions for Form 1099MISC, Miscellaneous Income Inst 1099MISC Instructions for Form 1099MISC, Miscellaneous Income 19 Inst 1099MISC and 1099NEC

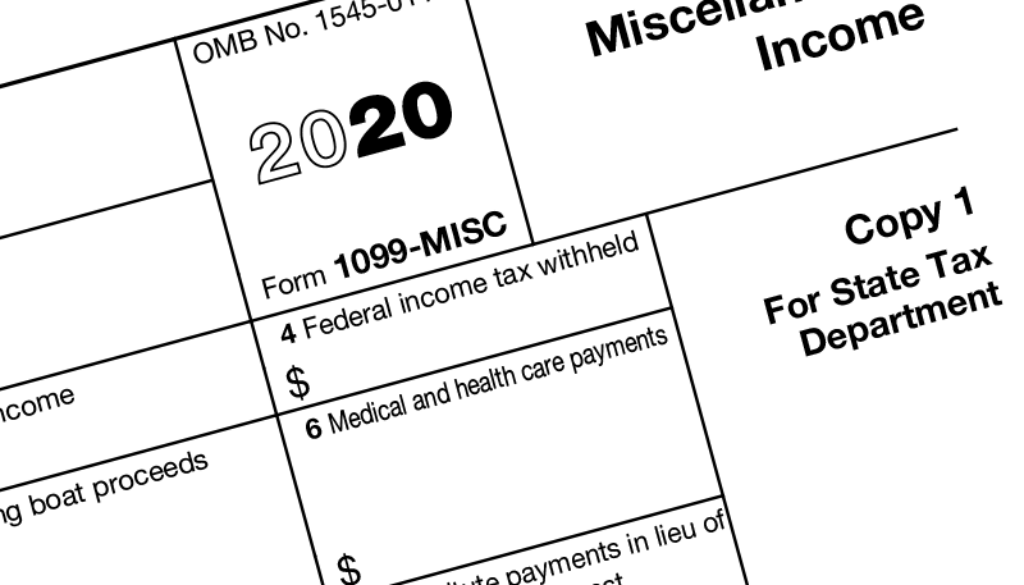

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

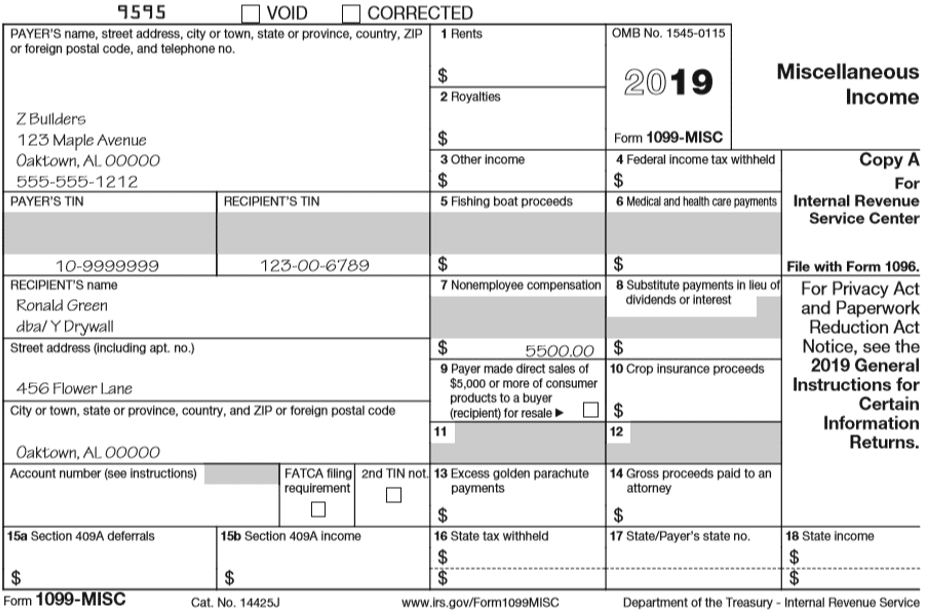

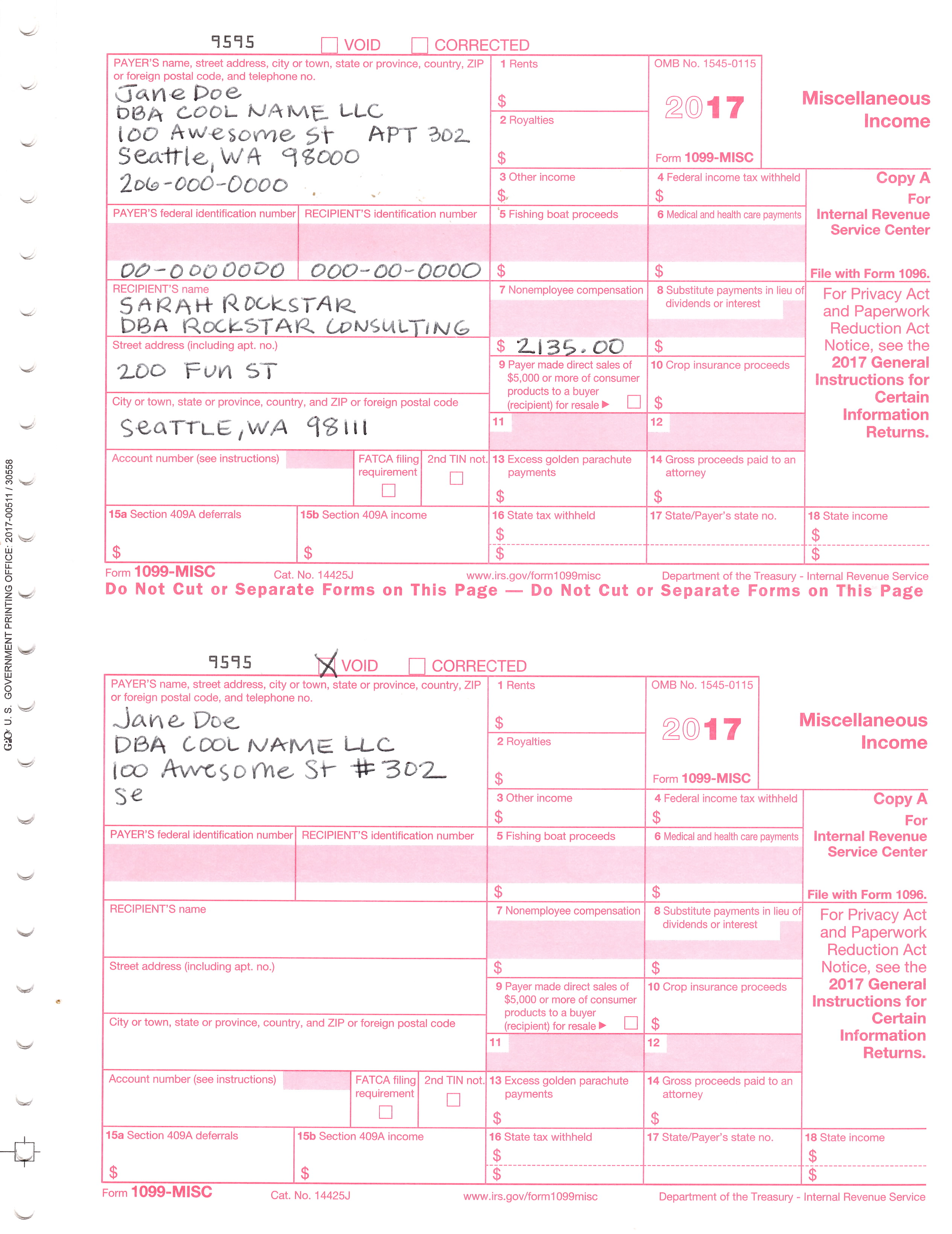

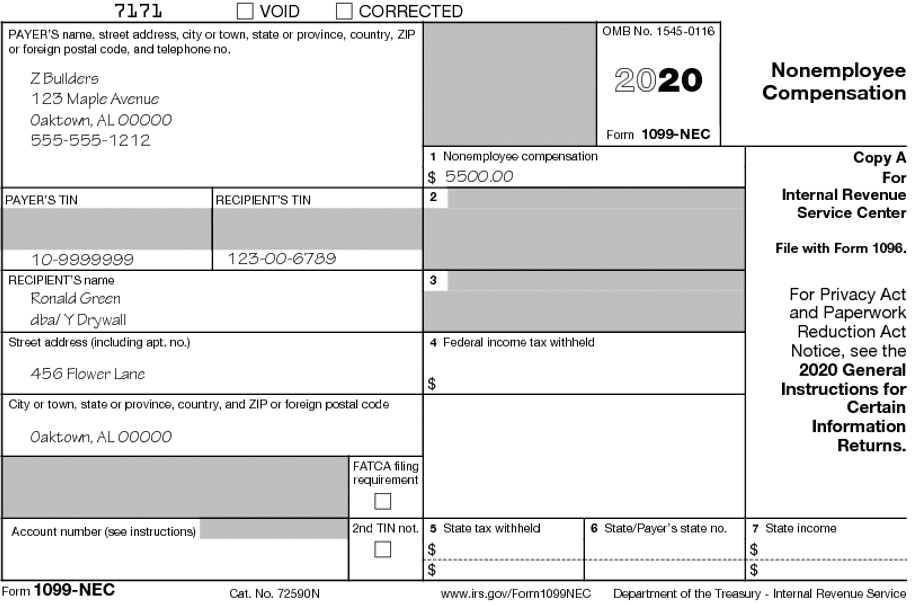

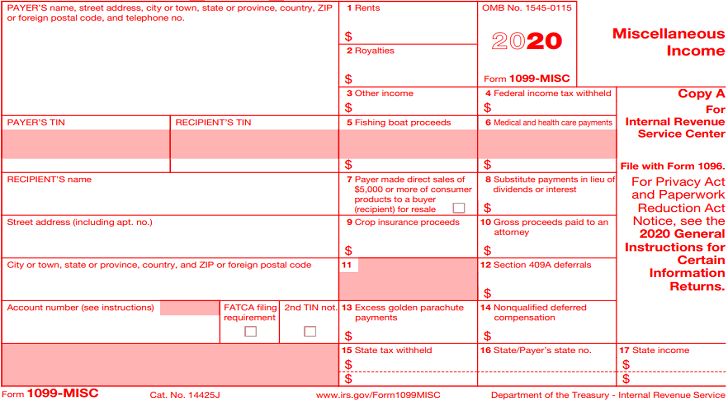

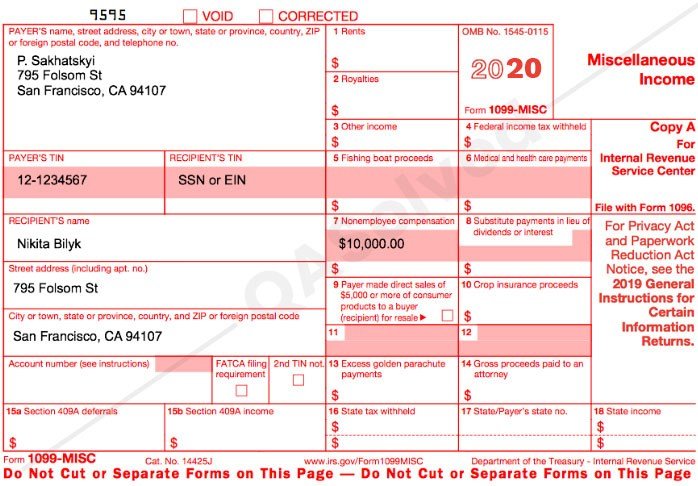

Completed 1099 misc 2020

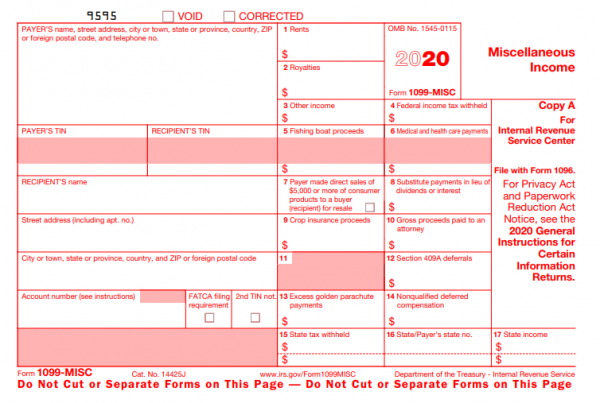

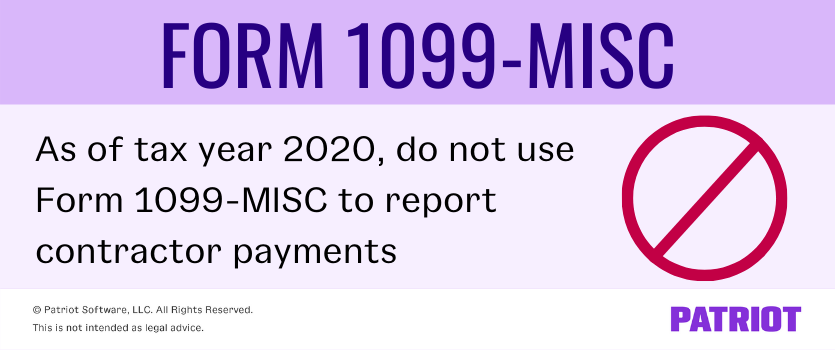

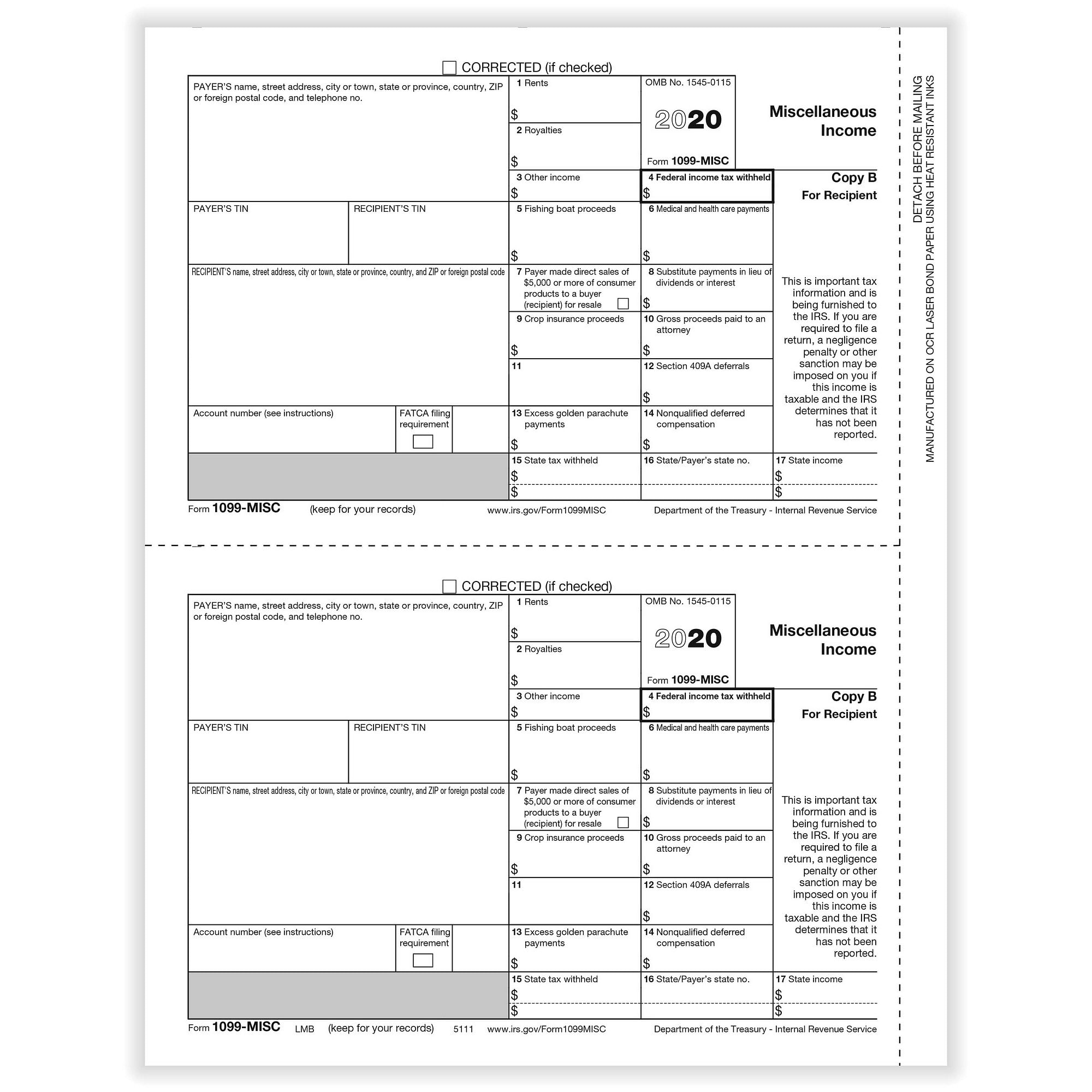

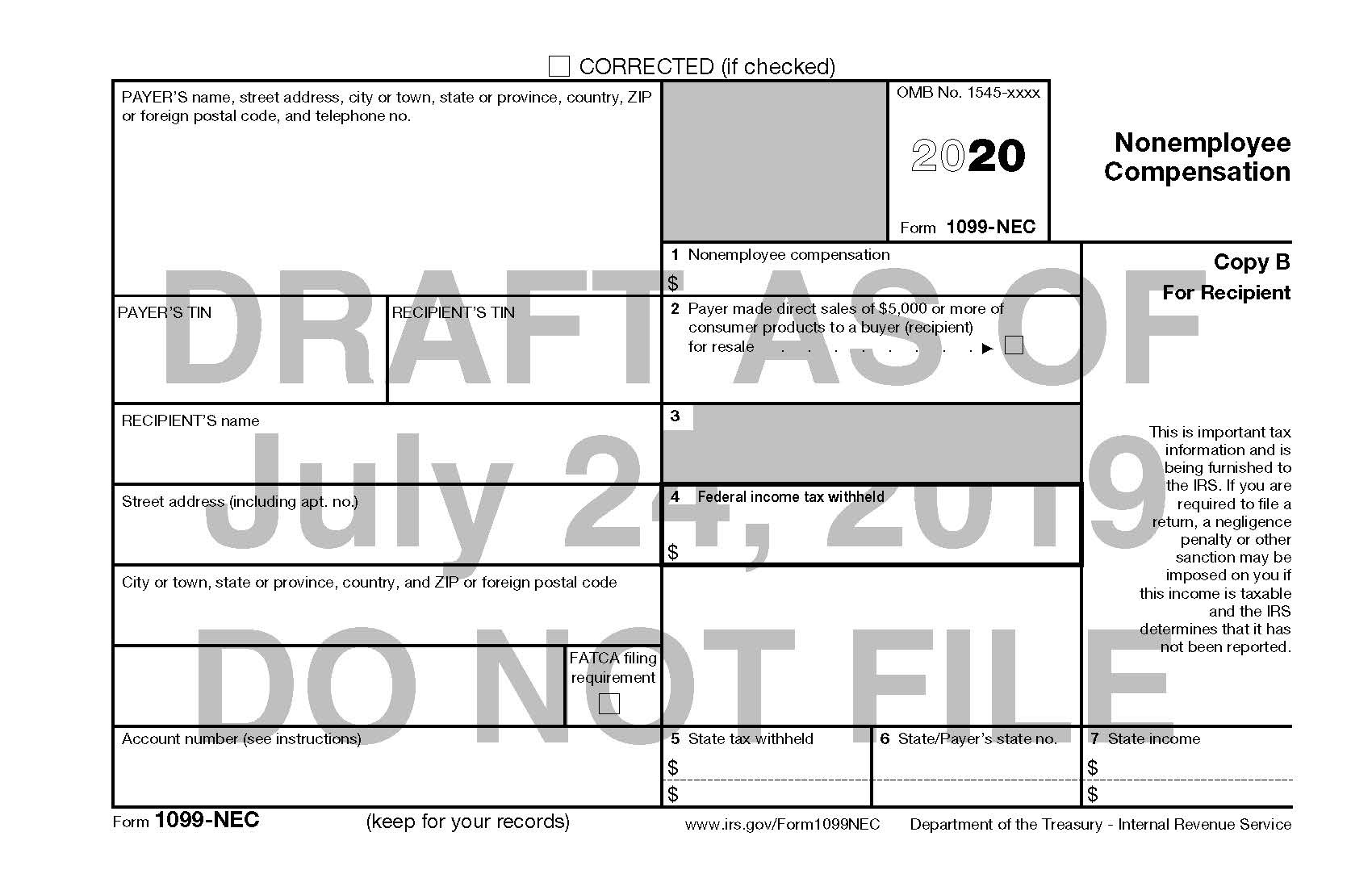

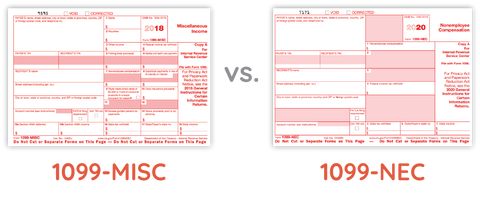

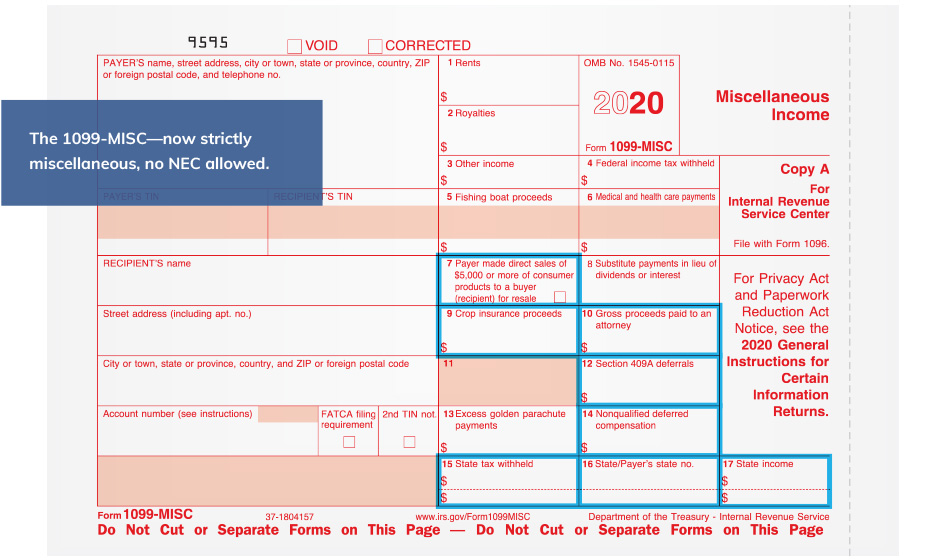

Completed 1099 misc 2020-Sep 17, · Form 1099MISC vs Form 1099NEC Beginning with the tax year, you must use two different forms to report different types of payments The two forms are similar, but due dates are different1099NEC, new form starting Formerly Box 7 of 1099MISC 2 1099MISC, Common version Box 3 OTHER INCOME plus Rents and Royalties 3 ATTORNEY 1099MISC Box 3 Other Income plus Attorney & Medical Payments Perfect for attorneys 4 1099

Form Irs 1099 Misc Fill Online Printable Fillable Blank Pdffiller

How to Prepare a 1099 MISC Form Did you pay an independent contractor compensation of $600 as miscellaneous income?Starting with the tax year of , a 1099MISC Form is meant to be filed for every person (ie nonemployee) you have paid over $600 for an assorted list of miscellaneous business payments The list of payments that require a business to file a 1099MISC form is featured belowThe comprehensive 1099 Misc forms for are perfect for businesses keen on convenience and costefficiency Our tax forms are suitable for business reporting of different payments such as rents, royalties, medical and health payouts and nonemployee remuneration

Complete 3Part Laser 1099 Misc Tax Form Set and 1096 Kit for 50 Vendors, Good for QB and Accounting Software,1099 Misc Visit the Dutymark Store 45 out of 5 stars 69 ratings Price $2498 Get Fast, Free Shipping with Amazon Prime & FREE Returns Return this item for freeNov , · The IRS has introduced Form 1099NEC for the tax year, making a distinction between payments to nonemployees and other types of miscellaneous payments a business might make The form doesn't replace Form 1099MISC It just separates payments made to nonemployees onto this different form for reporting purposesIn addition, use Form 1099MISC to report that you made direct sales of at least $5,000 of consumer products to a buyer for resale anywhere other than a permanent retail establishment Current Revision Form 1099MISC PDF Instructions for Forms 1099MISC and 1099

Inst 1099MISC Instructions for Form 1099MISC, Miscellaneous Income Inst 1099MISC Instructions for Form 1099MISC, Miscellaneous Income 19 Inst 1099MISC and 1099NECJan 25, 21 · Including 1099 Income on Your Tax Return How you report 1099MISC income on your income tax return depends on the type of business you own If you are a sole proprietor or singlemember LLC owner, you report 1099 income on Schedule C—Profit or Loss From BusinessWhen you complete Schedule C, you report all business income and expensesSo, as a 1099 provider, you must know when you use 1099 Misc and 1099 NEC for reporting payments Why IRS Introduced 1099NEC For ?

1099 Nec A New Way To Report Non Employee Compensation

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

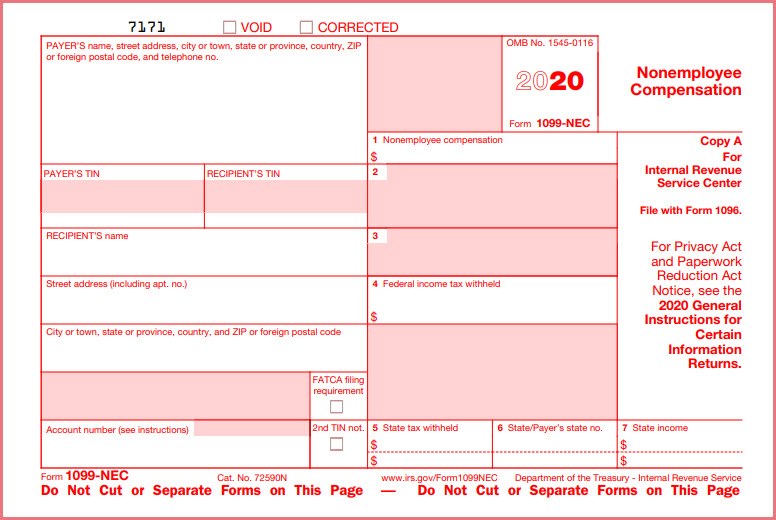

Mar 29, 21 · Those making payments to nonemployees must issue the newly introduced Form 1099NEC to nonemployees and independent contractors, rather than Form 1099MISC, but Form 1099MISC is still alive and well It now reports other sources of income, including the vaguesounding "Other Income" Dec 16, · What is a 1099 tax form?1099NEC is an old form but IRS reintroduce to avoiding deadline confusion Form 1099Misc used

Your Ultimate Guide To 1099s

1099 Misc 4 Part Tax Forms Bundle With Software And Self Seal Env Blue Summit Supplies

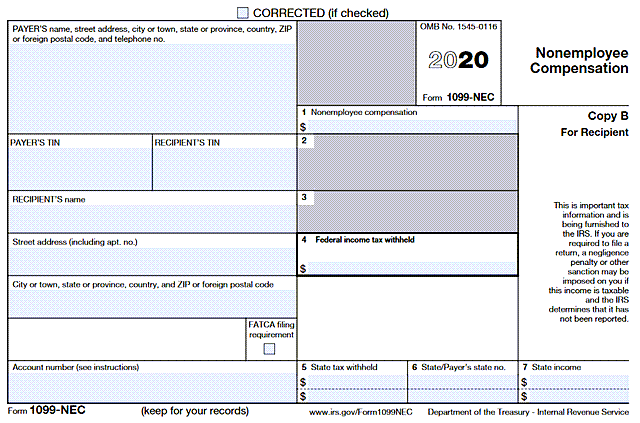

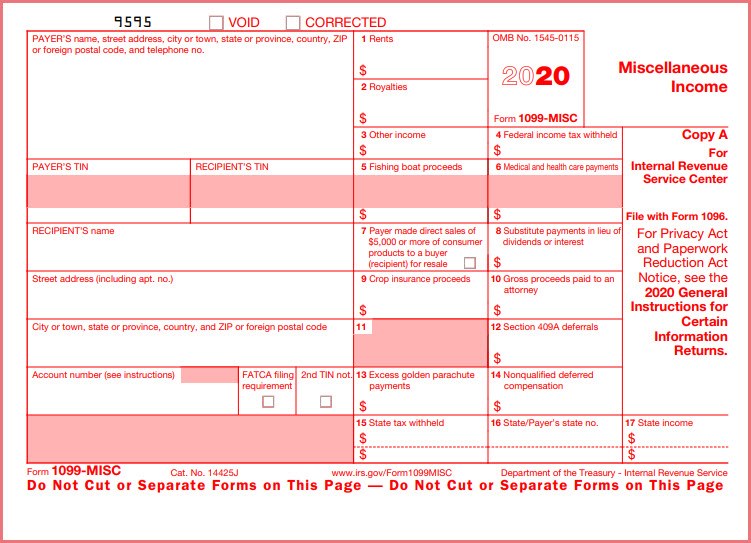

Form 1099MISC Cat No J Miscellaneous Income Copy A For Internal Revenue Service Center Department of the Treasury Internal Revenue ServiceA 1099 is an "information filing form", used to report nonsalary income to the IRS for federal tax purposes There are variants of 1099s, but the most popular is the 1099NEC If you paid an independent contractor more than $600 in a financial year, you'll need to complete a 1099NECForm 1099NEC The PATH Act, PL , Div Q, sec 1, accelerated the due date for filing Form 1099 that includes nonemployee compensation (NEC) from February 28 to January 31 and eliminated the automatic 30day extension for forms that include NEC Beginning with tax year , use Form 1099NEC to report nonemployee compensation

Irs 1099 Changes Impact On Microsoft Dynamics Gp Rand Group

Get Clear On The Difference Between The 1099 Misc And 1099 Nec

Dec 14, · 1099NEC vs 1099MISC The 1099NEC is now used to report independent contractor income But the 1099MISC form is still around, it's just used to report miscellaneous income such as rent or payments to an attorney Although the 1099MISC is still in use, contractor payments made in and beyond will be reported on the new form 1099NECMar 18, 21 · Form 1099MISC Form 1099MISC is for miscellaneous income This could be from work you did as a freelancer, independent contractor or intern Regular salaried and hourly workers will have their income reported on W2 forms Anyone who paid an independent contractor, though, will report that person's wages on a 1099MISCForm 1099 is a tax form that is used to report income that you received which needs to reported on your tax return The payer sends the proper 1099 to the IRS and a copy of the form to you There are many different kinds of 1099 forms, each of which is designated by one or more letters (such as 1099K or 1099MISC)

New Form 1099 Reporting Requirements For Atkg Llp

1099 Nec And 1099 Misc Changes And Requirements For Property Management

Reported on Form 1099MISC for additional tax calculation See the Instructions for Forms 1040 and 1040SR, or the Instructions for Form 1040NR Box 2 Reserved Box 3 To complete Form 1099NEC, use • The General Instructions for Certain Information Returns, and • The Instructions for Forms 1099MISC andJun 30, · You must send the contractors and the IRS a Form 1099MISC—or, starting in tax year , a Form 1099NEC—to notify them about the amount of nonemployee income you paid to the contractors You will use Form 1096 to summarize the information provided on all the 1099MISC or 1099NEC forms you sent to contractorsSTEP 3 Prepare Your 1099 MISC Forms Start preparing 1099 MISC forms for independent contractors, once you have bought the 1099 forms Fill in your Federal Tax ID number (SSN or EIN) and contractor's information (SSN or EIN) accurately Ensure you enter the same amount of money you paid to the contractor in Box 7 under the title "Nonemployee compensation"

Irs Makes Substantial Changes To 1099 Misc Form Williams Keepers Llc

How To Fill Out Irs Form 1099 Misc Easy Instructions Tipalti

Mar 25, 17 · Even if the entity you compensate is a business, you are still required to issue a 1099 The exception to this is if the entity is a corporation or other 1099exempt organization 1099MISC instructions How to fill out the form Before you fill out a 1099MISC form, ensure that you order Form 1099MISC online or by phone Payer and recipientJan 22, · A 1099Misc is an IRS form required to be completed and sent to nonemployees no later than January 31, Similar to a W2, a 1099Misc is a tax form showing how much was paid to a vendor or subcontractor throughout the yearThe IRS has reintroduced Form 1099NEC as the new way to report selfemployment income instead of Form 1099MISC as traditionally had been used This was done to help clarify the separate filing deadlines on Form 1099MISC and the new 1099NEC form will be used starting with the tax year

Irs Introduces New Ish Form To Replace Parts Of Form 1099 Misc Taxgirl

Memo For 1099 Nec Replaces 1099 Misc For Nec Non Employee Compensation Chris Whalen Cpa

Beginning in tax year , businesses will complete a 1099NEC, or Nonemployee Compensation, to report nonemployee payments of $600 or more The 1099NEC form has replaced what used to be recorded on Form 1099MISC, Box 7IRS Publication 1 A document published by the Internal Revenue Service that identifies a taxpayer's rights and outlines the processes followed by the IRS when it examines a taxpayer, issues aJan 06, · If you work as an independent contractor or are selfemployed it is important to stay up to date on the latest tax changes As we start gearing up for tax season, you may be wondering what has changed for tax year 19 (filed in ) With the passage of the Tax Cuts and Jobs Act, a lot of tax changes were implemented last year, like an increase in the standard deduction and

Form Irs 1099 Misc Fill Online Printable Fillable Blank Pdffiller

1099 Nec And 1099 Misc Changes And Requirements For Property Management

Corrections for prior years will be completed on the 1099 Misc form thru the 1099 Express program using box 11 The information is given a specific code in the program created by the IRS and will be processed on all years prior to Once the correction box is checked on the 1099 Misc form box 11 will allow data entryThis item 1099 MISC Forms , 5Part Set And 1096 Kit For 25 Vendors Complete Laser All 1099 Tax Forms in $38 50 1099 MISC and 1099 NEC Tax Envelopes Designed for printed 1099 Laser Forms from Quickbooks or $1199 Special offers and product promotionsForms 1098 and 1099A, complete one Form 1096 to transmit your Forms 1098 and another Form 1096 to transmit your Forms 1099A You need not submit original and corrected returns separately Do not send a form (1099, 5498, etc) containing

1099 Misc Forms 5 Part Set And 1096 Kit For 25 Vendors Complete Laser All 1099 Tax Forms In Value Pack 1099 Misc Office Products Amazon Com

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

Form 1099MISC is the most common type of 1099 form Companies use it to report income earned by people who work as independent contractors rather than regular payroll employees The IRS requires businesses to file a copy of the 1099 form with them and mail another copy directly to the independent contractor so that the IRS can predict how muchComplete 1099 misc Forms for and 1096 Tax Form and self Seal envelopes, All 1099 Government Approved kit for 10 vendors 43 out of 5 stars 173 #1 Best Seller in Tax FormsThen you need to prepare a 1099 MISC Form and issue it to the independent contractor Form 1099 MISC is a generalpurpose IRS form for reporting payments to others during the year This Form is redesigned in to remove the reporting of non

1099 Misc Form Copy C 2 Recipient State Zbp Forms

Form 1099 Nec Now Used To Report Nonemployee Compensation Ohio Ag Manager

Feb 09, 21 · marks a slight change in IRS filing requirements If you've filed a 1099MISC in the past, these changes probably apply to you or your business Before , you likely filed a 1099 MISC for reporting both your miscellaneous payments and all nonemployee compensation Now, the IRS has reintroduced the 1099 NEC for reporting this nonemployee compensation Since the 1099 MISCPrePrinted 1099MISC Kits Use federal 1099MISC tax forms to report payments of $600 or more for rents, royalties, medical and health care payments, and gross proceeds paid to attorneys View larger imageDec 30, · The 1099Misc listed royalties, rents, and other miscellaneous items, but its most common use was for payments to independent contractors Starting in , the IRS now requires payments to independent contractors are shown on a new form 1099NEC (nonemployee compensation) instead of the 1099MISC (miscellaneous)

Form 1099 Nec Returns Form 1099 Misc Minneapolis St Paul Mn

Get Clear On The Difference Between The 1099 Misc And 1099 Nec

Nov 03, · In the past, businesses had to use Form 1099MISC to report independent contractor payments in addition to the other types of miscellaneous income However in , the IRS brought back Form 1099NEC, Nonemployee Compensation, to report nonemployee compensation Business owners used to report nonemployee compensation on Form 1099NECComplete Your 1099 Efiling in Simple Steps e file 1099 MISC INDEPENDENT CONTRACTOR'S INCOME If a independent contractor or selfemployed person is working for you or render a service from a company then you must issue a Efile 1099 misc form for each client that made payments $600 or more during the tax year1099MISC 21 Miscellaneous Information Copy 1 For State Tax Department Department of the Treasury Internal Revenue Service OMB No VOID CORRECTED PAYER'S name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone no PAYER'S TIN RECIPIENT'S TINRECIPIENT'S name

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

How To Fill Out Send 1099 Misc Forms Seattle Business Apothecary Resource Center For Self Employed Women

Completing your 1099 forms is easy with this fillable Word template Just open the Word document, fill in your recipient's information, and print the info onto your paper 1099 form Works best on inkjet printers where manual adjustment of the paper form is easierAmazon's Choice for " 1099 misc forms " COMPREHENSIVE INCOME TAX FILING KIT Our 1099 forms can be used to report miscellaneous payments such as rents, royalties, medical and health payments and nonemployee compensation1099 MISC Forms , 1099 MISC Laser Forms IRS Approved Designed for Quickbooks and Accounting Software , 4 Part Tax Forms Kit, 25 Envelopes Self Seal, 25 Vendor Kit Total 54 (105) Forms 33 $19 99

Printable Form 1099 Misc 21 Insctuctions What Is 1099 Misc Tax Form

Form 1099 Misc Instructions And Tax Reporting Guide

Hhm

How To Fill Out And Print 1099 Nec Forms

1099 Misc 5 Part Tax Forms Kit 100 Count Blue Summit Supplies

Irs Launches New Form Replacing 1099 Misc For Wicz

Instant Form 1099 Generator Create 1099 Easily Form Pros

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Irs Launches New Form Replacing 1099 Misc For Contractors In Cpa Practice Advisor

1099 Misc Forms 3 Part 1099 And 1096 Kit For 50 Vendors All 1099 Forms With Self Seal Envelopes In Value Pack 1099 Misc Office Products Amazon Com

1099 Misc Miscellaneous Income 5 Part 2 Up Packaged Set

Amazon Com 1099 Misc Forms 5 Part Set And 1096 Kit For 25 Vendors Complete Laser All 1099 Tax Forms In Value Pack 1099 Misc Office Products

Video What You Need To Know About Form 1099 Nec Olsen Thielen Certified Public Accountants Consultants

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg)

Form 1099 Misc Miscellaneous Income Definition

Irs Releases Form 1099 Nec Why The Fuss Grennan Fender

How To Fill Out Form 1099 Misc Reporting Miscellaneous Income

How To Fill Out Irs 1099 Misc 19 Form Pdf Expert

1099 Misc Tax Form Pressure Seal W 2taxforms Com

Form 1099 Misc Vs Form 1099 Nec How Are They Different

Change To 1099 Form For Reporting Non Employee Compensation Ds B

1099 Misc Copy A Laser W 2taxforms Com

1099 Misc Form Fillable Printable Download Free Instructions

1099 Misc Copy C State Laser W 2taxforms Com

1099 Misc Form Fillable Printable Download Free Instructions

1099 Misc Miscellaneous Rec Copy B Cut Sheet 400 Forms Pack

Businesses Have Feb 1 Deadline To Provide Forms 1099 Misc And 1099 Nec To Recipients Mychesco

Form 1099 Nec For Nonemployee Compensation H R Block

1099 Misc Forms Official Archives Zbp Forms

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

Instructions For Forms 1099 Misc And 1099 Nec Internal Revenue Service

1099 Nec Carbonless Continuous Forms Discount Tax Forms

Irs To Bring Back Form 1099 Nec Last Used In 19 Current Federal Tax Developments

Irs 1099 Changes Impact On Microsoft Dynamics Gp Rand Group

1099 Misc Public Documents 1099 Pro Wiki

How To Fill Out Irs 1099 Misc 19 Form Pdf Expert

What Is Form 1099 Misc When Do I Need To File A 1099 Misc Gusto

There S A New Tax Form With Some Changes For Freelancers Gig Workers

How To Add 1099 Nec To Your Sage 100 Tax Forms

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Acumatica 1099 Nec Reporting Changes Crestwood Associates

Get Clear On The Difference Between The 1099 Misc And 1099 Nec

What Is The Account Number On A 1099 Misc Form Workful

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

Form 1099 Misc It S Your Yale

Amazon Com Complete 3 Part Laser 1099 Misc Tax Form Set And 1096 Kit For 50 Vendors Good For Qb And Accounting Software 1099 Misc Office Products

Form 1099 Nec Requirements Deadlines And Penalties Efile360

1099 Misc Form Copy A Federal Discount Tax Forms

Form 1099 Nec Or Form 1099 Misc Delano Sherley Associates Inc

:max_bytes(150000):strip_icc()/ScreenShot2020-08-20at4.33.51PM-544b6d1adff646f68daaa86ef975a0d8.png)

Form 1099 Misc What Is It

New Irs Rules For 1099 Independent Contractors

Order 1099 Nec Misc Forms Envelopes To Print File

1099 Misc Form Fillable Printable Download Free Instructions

1099 Misc Form Fillable Printable Download Free Instructions

Form 1099 Nec Now Used To Report Non Employee Compensation Ohio Dairy Industry Resources Center

Irs 1099 Misc Vs 1099 Nec Inform Decisions

Quickbooks 1099 Tax Form Changes At Year End Insightfulaccountant Com

1099 Misc Form Copy B Recipient Discount Tax Forms

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Amazon Com 1099 Misc Forms 3 Part 1099 And 1096 Kit For 50 Vendors All 1099 Forms With Self Seal Envelopes In Value Pack 1099 Misc Office Products

1099 Nec Or 1099 Misc What Has Changed And Why It Matters Pro News Report

What Is Irs Form 1099 Misc Weny News

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

What Is Form 1099 Nec How Do I File Form 1099 Nec Gusto

1099 Misc Nonemployee Compensation Is Now Form 1099 Nec Blue Summit Supplies

Amazon Com 1099 Misc Forms 4 Part Laser Tax Forms Kit With Self Seal Envelopes For 25 Individuals Designed For Quickbooks And Accounting Software Office Products

The New 1099 Nec

Umm Maybe I Forget To Start Using The 1099 Nec Form And Boxes Umm Help Sage X3 Support Sage X3 Sage City Community

Quickbooks 1099 Tax Form Changes At Year End Insightfulaccountant Com

1099 Misc Software To Create Print E File Irs Form 1099 Misc

Amazon Com 1099 Misc Federal Copy A Income Form 100 Laser Tax Recipients Pack Office Products

How To File A 1099 Misc Online 21 Qasolved

:max_bytes(150000):strip_icc()/Form1099-NEC-46cc30fa3f2646d8be4987b14d4aa5d4.png)

Form 1099 Nec What Is It

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

New Form 1099 Nec Sek

The Irs Resurrects Form 1099 Nec After A 38 Year Absence

Irs 1099 Misc Form Pdffiller

Umm Maybe I Forget To Start Using The 1099 Nec Form And Boxes Umm Help Sage X3 Support Sage X3 Sage City Community

0 件のコメント:

コメントを投稿