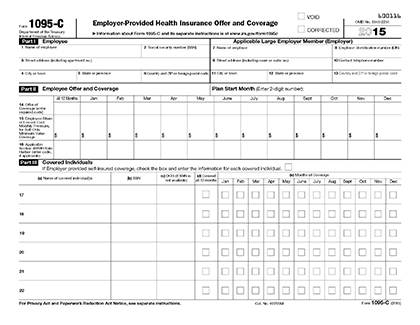

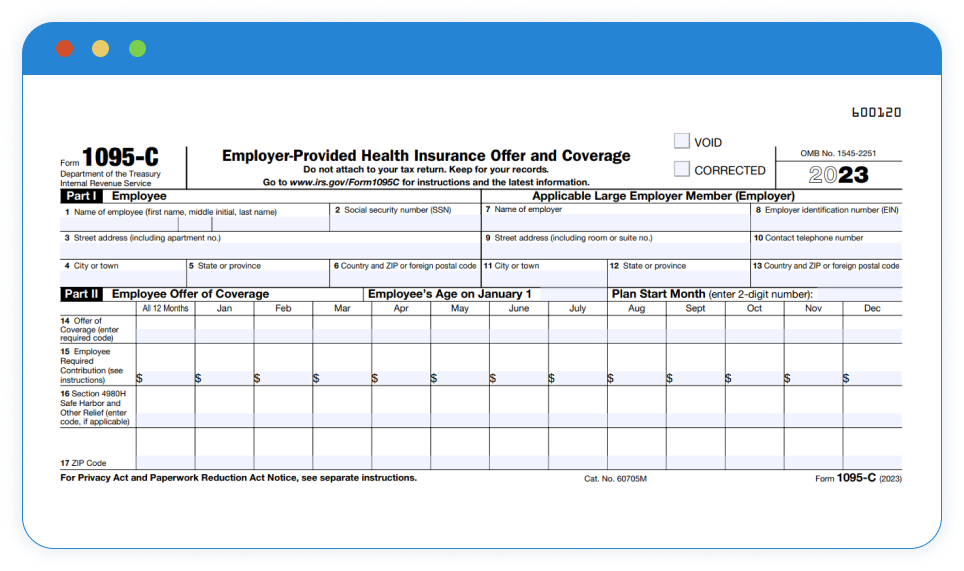

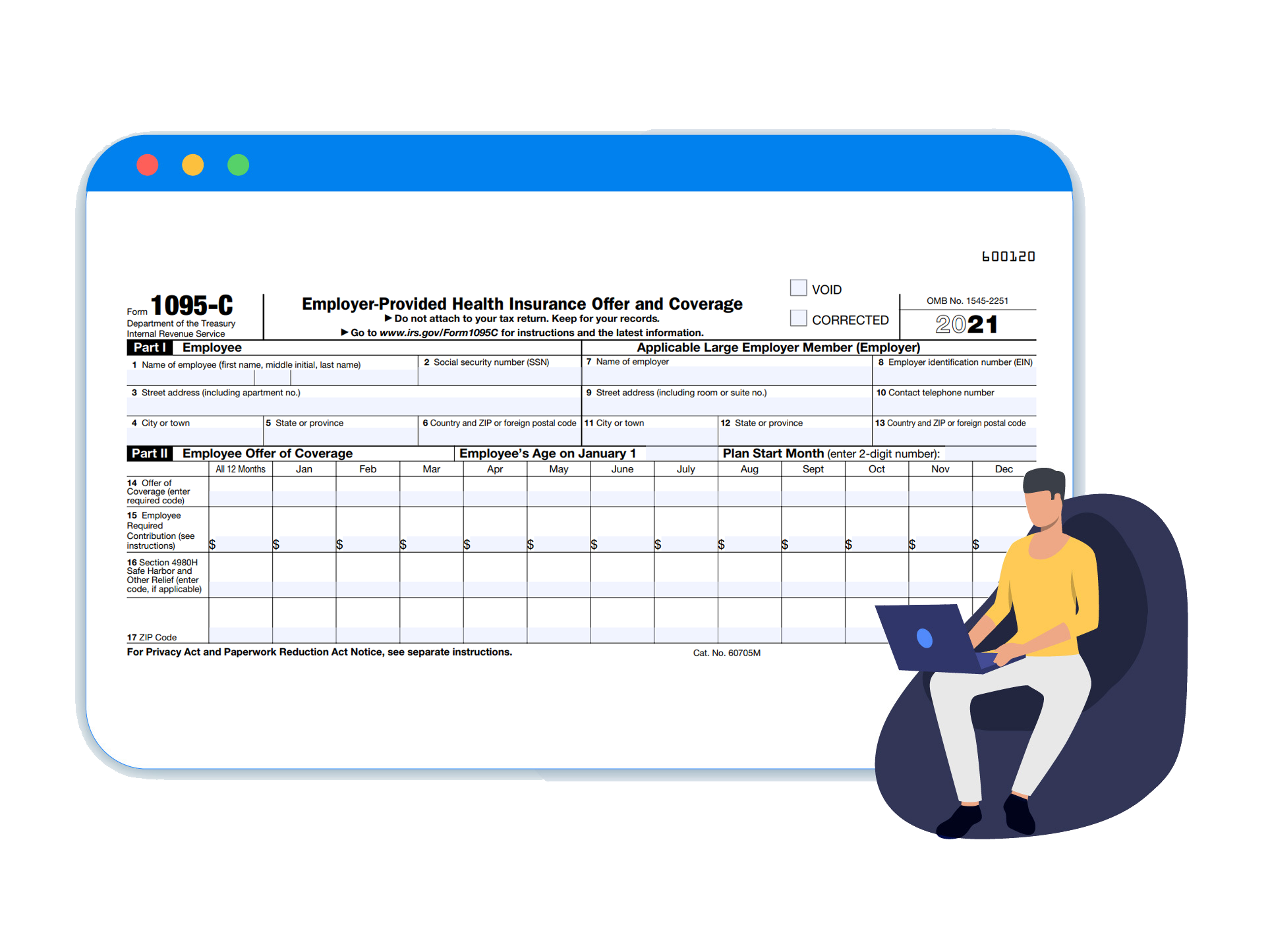

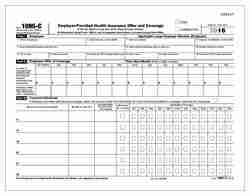

In late May the IRS released its 21 draft Form 1095C The 21 reporting season will be the seventh time applicable large employers (ALEs) have been required to furnish the IRS the Forms 1094C and 1095C While many employers are settling into the annual reporting requirement, there are still many employers who are falling short of the required guidelines and In July 21, the Internal Revenue Service (IRS) issued an early release draft of Form 1095C—an important ACA reporting document While not ready for publication and use just yet, human resources departments should take note of a few updates to Form 1095C—and prepare for potential changes to 1094CsInformation, put and request legallybinding digital signatures Get the job done from any device and share docs by email or fax

1095 C Updates For 21 Hr High Notes Youtube

1095 c form 2020 fill in

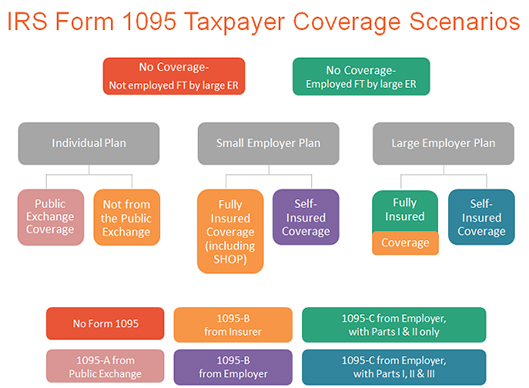

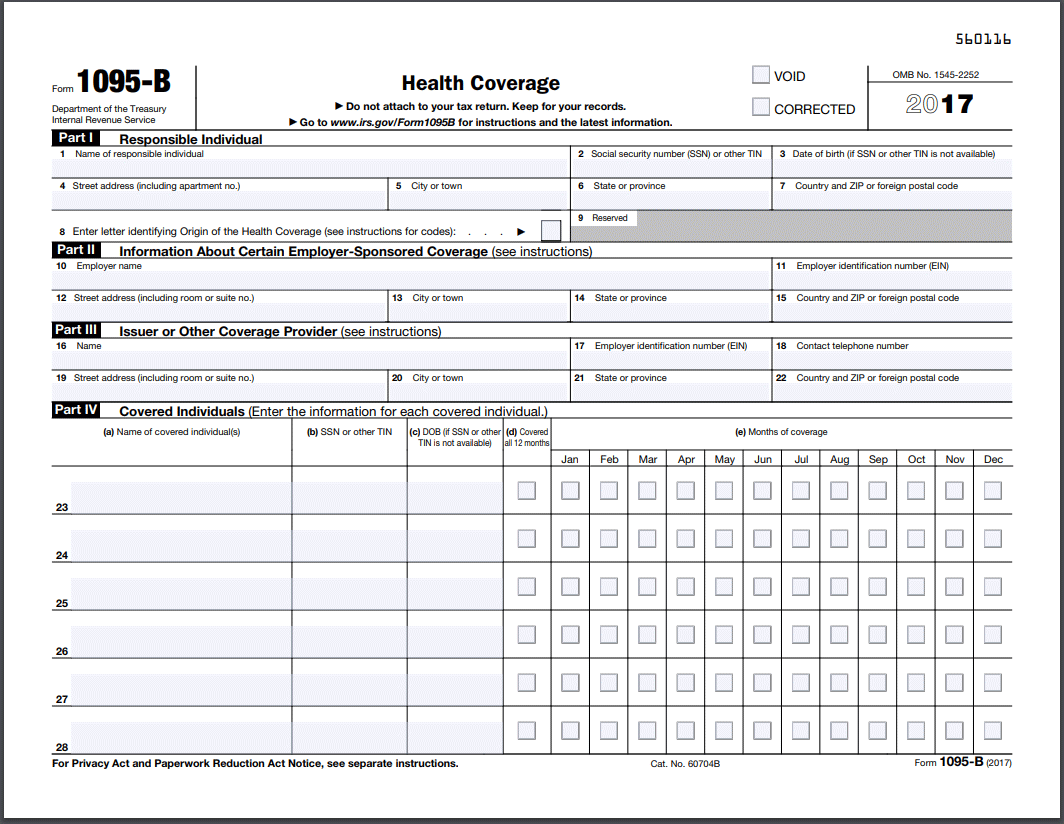

1095 c form 2020 fill in-Form 1095A Health Insurance Marketplace Statement 21 Form 1095C EmployerProvided Health Insurance Offer and Coverage 21 Form 1095B Traditionally, filers of Forms 1095B, 1094C, and 1095C may receive an automatic 30day extension of time to file these Forms with the IRS if they submit an IRS Form 09, Application for Extension of Time to File Information Returns, on or before the due date for filing those forms

Form 1095 C To Arrive In February University Of Pennsylvania Almanac

(Form 1095C, Line 14) CODE SERIES 1 Offer of Coverage 1A Qualifying Offer Minimum essential coverage providing minimum value offered to fulltime employee with Employee Required Contribution equal to or less than 95% (as adjusted) of mainland single federal poverty line and at least minimum essential Find us at https//wwwbernieportalcom/hrpartyofone/In , the IRS issued a few key updates to Form 1095C Now, all applicable large employers (ALEs)Instructions for Form 1098, Mortgage Interest Statement Inst 1098 Instructions for Form 1098, Mortgage Interest Statement 21 Form 1098C Contributions of Motor Vehicles, Boats, and Airplanes (Info Copy Only) 19 Form 1098C

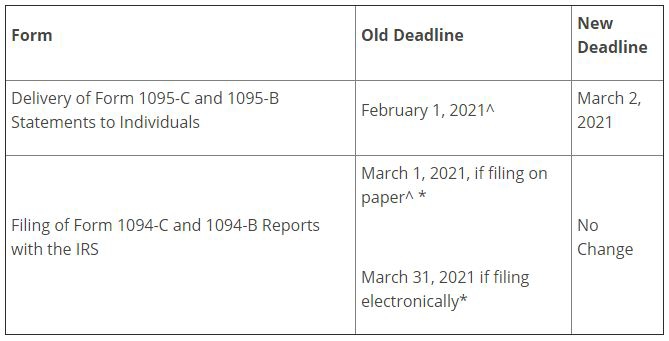

On , the IRS issued Notice 76 ("Notice"), which automatically extends the employer deadline to distribute Forms 1095B/C to plan participants from to In addition, the Notice extends the penalty relief for employers who fail to furnish Forms 1095B and the penalty relief for goodfaith errors in reporting, if certain Submission to the IRS Forms 1094C, 1095C, 1094B, and 1095B forms must be filed with the IRS by if filing on paper (or March 31 if filing electronically) Electronic filing is mandatory for entities required to file 250 or more Forms 1095 August 2225, 21 Support and shape the future of talent management live online, or inperson On July 13, the IRS released for comments a draft of Form 1095C EmployerProvided Health

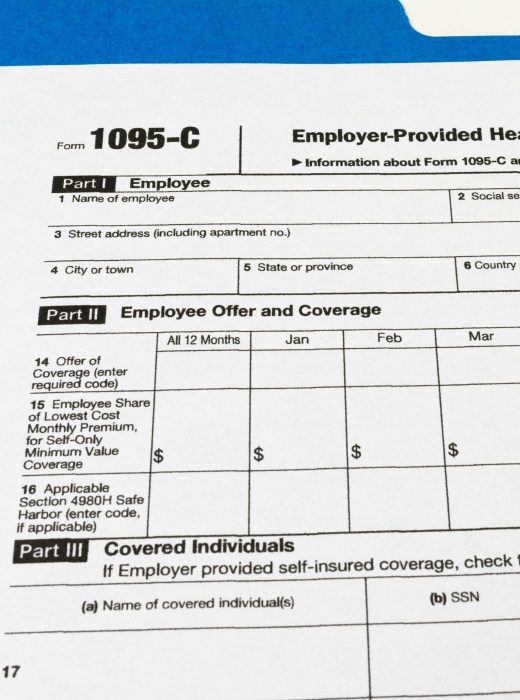

All fulltime employees at companies with more than 50 fulltime employees will now receive a Form 1095C to report health care coverage offered by their empData, put and ask for legallybinding digital signatures Do the job from any device and share docs by email or faxEmployers have until January 31 to send the form to their employees Thus, a 1095C form will be sent in early January 21

Affordable Care Act Deadlines Extended For Notices Lexology

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

ACA Reporting Penalties $280/Form Penalty, $560/Employee Penalty for Late/Incorrect Forms The general potential late/incorrect ACA reporting penalties are $280 for the late/incorrect Forms 1095C furnished to employees, and $280 for the late/incorrect Forms 1094C and copies of the Forms 1095C filed with the IRS TaxBandits is an IRScertified efile provider for various IRS tax forms, including 1095 forms, 1095B, 1095C, 1094B, and 1094C We have offered efiling services for 70,000 customers Our application is built with userfriendly features to make your ACA reporting easy for the tax year1095c due date 1921 Complete forms electronically working with PDF or Word format Make them reusable by making templates, include and complete fillable fields Approve documents by using a lawful electronic signature and share them via email, fax or print them out download documents on your personal computer or mobile device Boost your efficiency with effective

1095 C Updates For 21 Hr High Notes Youtube

New Tax Document For Employees Duke Today

Employers are required to furnish Form 1095C only to the employee As the recipient of TIPthis Form 1095C, you should provide a copy to any family members covered under a selfinsured employersponsored plan listed in Part III if they request it for their records1095C Form 21 📝 Get IRS Form 1095C Fillable Instructions for Healthcare Marketplace Tax Form with Codes Description Get 📝 IRS Form 1095C 🟢 Form for employee's health insurance 🟢 Fill 1095 C Tax Form online or download printable version in PDF, DOC or RTF 🟢 In July 21, the Internal Revenue Service (IRS) issued an early release draft of Form 1095C—an important ACA reporting documentWhile not ready for publication and use just yet, human resources departments should take note of a few updates to Form 1095C—and prepare for potential changes to 1094Cs

Form 1095 A 1095 B 1095 C And Instructions

Form 1095 C To Arrive In February University Of Pennsylvania Almanac

Eligible for health coverage in should receive a Form 1095C by Even if you declined to sign up for a health plan with VMware, you will still receive Form 1095C Information on this form will also be reported to the IRS VMware's Form 1095C will indicate your name, the months during when you were offered coverage,The IRS extends the Form 1095 recipient copy deadline from , to The 1095B / 1095C Forms need to be efiled with the IRS on or before If you choose to file ACA Forms by paper, you must file before Information Required for 21 ACA Reporting (Previously January 31) Previously January 31, the IRS extended the deadline to furnish the 1095C forms to employees for the 21 tax year to March 2 Make sure that you're distributing 1095C forms to all of your ACA fulltime employees Failure to do so could result in a Failure to Furnish penalty under IRC Section 6722

1095 C Employer Provided Health Insurance Irs Continuation Copy For 21 5098a Tf5098a

1

Form 1095C is a tax form that provides you with information about employerprovided health insurance Only employees who is offered coverage under a policy through an Applicable Large Employer (ALE) receive Forms 1095C, and it is the responsibility of the ALE to generate and furnish the documents to all employees who were fulltime (as defined by the ACA) For likely the final time, the IRS has issued Notice 76 extending by 30 days the 21 deadline to furnish the Forms 1095B and 1095C to individuals The Notice mirrors the same 30day extensions for the past four years of ACA reporting1095 c form 21 Reap the benefits of a digital solution to develop, edit and sign documents in PDF or Word format online Transform them into templates for multiple use, incorporate fillable fields to gather recipients?

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Ez1095 Software How To Print Form 1095 C And 1094 C

Form 1095C is filed and furnished to any employee of an Applicable Large Employers (ALE) member who is a fulltime employee for one or more months of the calendar ALE members must report that information for all twelve months of the calendar year for each employeeEditable IRS 1095C 21 Download blank or fill out online in PDF format Complete, sign, print and send your tax documents easily with US Legal Forms Secure and trusted digital platform!IRS Issues Draft Form 1095C for ACA Reporting in 21 On the IRS released for comments a draft of Form 1095C EmployerProvided Health Insurance Offer and Coverage Applicable large employers (ALEs) will use the final version of the form in early 21 to show that their health coverage complied with the Affordable Care Act

2

News 1095 C Tax Form Coming Soon

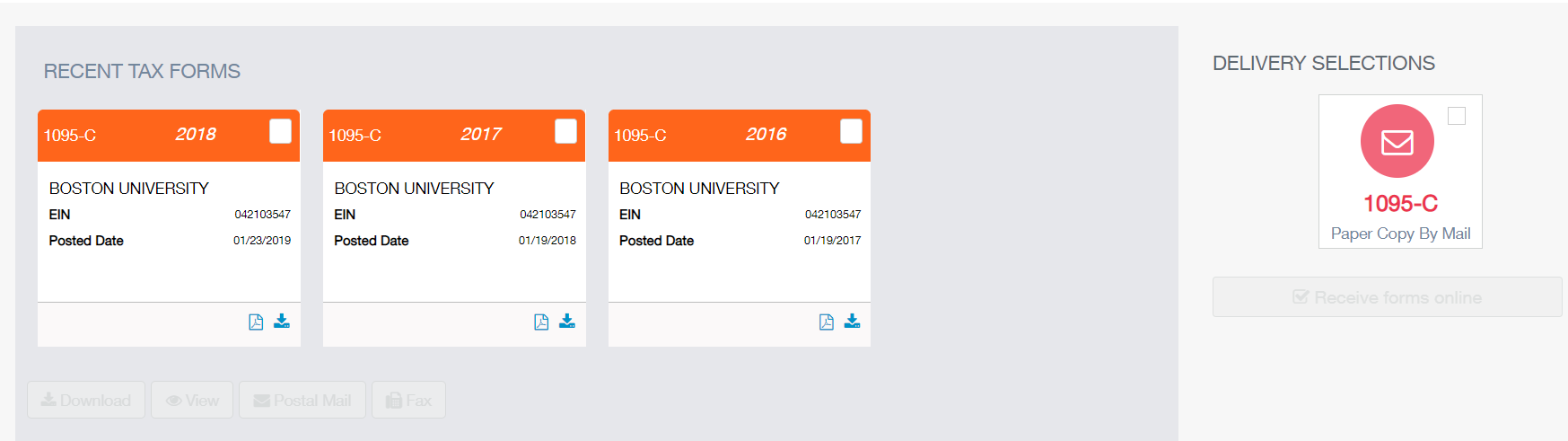

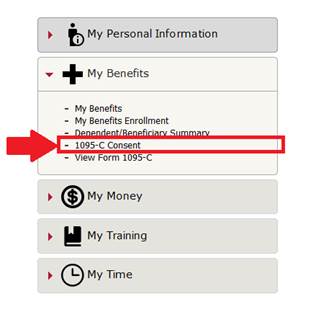

One of the must know features in our 1095 C software is employee copy distribution According to ACA reporting requirements under IRC section 6056, employers must submit the 1095 C forms to the IRS and distribute copies to employees To comply, our 1095 software handles the print and mailing of 1095 form copies to enrolled employees Furnish Forms 1095C to your fulltime employees no later than This date was originally , but the IRS has since issued an extension Employers must electronically file the Forms 1094C and 1095C with the IRS no later than this date The Internal Revenue Service (IRS) has released Notice 76, which extends the deadline for furnishing Forms 1095B and 1095C to individuals from to The Notice also provides penalty relief for goodfaith reporting errors and suspends the requirement to issue Form 1095B to individuals, under certain conditions

1095 C Updates For 21 Hr High Notes Youtube

New Form 1095 C Draft Issued By Irs For Filing In 22 Bernieportal

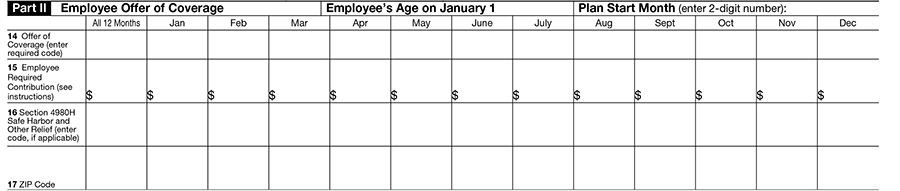

Form 1095C An IRS form sent to anyone who was offered health insurance coverage through his or her employer The form includes information you may have to provide on your federal tax returnThus, a 1095C form will be sent in early January 21 The IRS expects every ALE to send in a completed 1095C printable form for each eligible employee by the end of February If they choose to fill out the statement electronically, the IRS allows them to submit a 1095C online form until the end of MarchTo report the ICHRA coverage information on Form 1095C, the IRS adds new lines and codes (1L 1S), section to enter the zip code in Line 17, Section to enter the employee's age as of January 1 on PartII So, if you are looking for a 21 ACA reporting service provider, reach out to ACAwise

Q Tbn And9gcs1fntfgznhwhfmy G25cencwng1g4qikx94o Xop09o3khqbve Usqp Cau

What Your Clients Need To Know About Form 1095 C Accountingweb

Form 1095C State filing Forms 1094C and 1095C to the DC Office of Tax and Revenue (likely to include any federal extension) Deadline is 30 days after IRS deadline, including any extensions granted New Jersey Employee/nonemployee delivery Form 1095C State filing Form 1095C to the NJ Department of the Treasury IRS Form 1095 C Information Form 1095C is an annual statement that employers must provide fulltime employees and those covered by its health insurance plan You can get yours Mailed to your home Please be sure your current mailing address is in Self Service It will be mailed to you byAbout Form 1095C In late February 21, the Health Care Authority, on behalf of your employer or former employer, will mail Forms 1095C and an explanatory insert to Employee, retiree, and continuation coverage subscribers of state agencies, commodity commissions, or higher education institutions enrolled in Uniform Medical Plan for at least one month in 19

2

1095 C Faqs Mass Gov

In , the IRS issued a few key updates to Form 1095C Now, all applicable large employers (ALEs) have new codes to describe the affordability of coverage offered last year, as well as other key changes that apply to most other employers In this episode ofThe deadline to send forms 1095C and 1094C to the IRS on paper is , when filing electronically the due date is All data needed to fill 1095C / 1094C forms can be saved for later use and modification (forms stored for future access and corrections) This year, the IRS extended the deadline to provide employees with forms 1095C or 1095B to Before the announcement, Forms 1095B and 1095C were required to be furnished to employees—in other words, provided to employees—by The typical 30day extension to furnish information statements will not be granted

Www1 Nyc Gov Assets Olr Downloads Pdf Health 1095 C Form Pdf

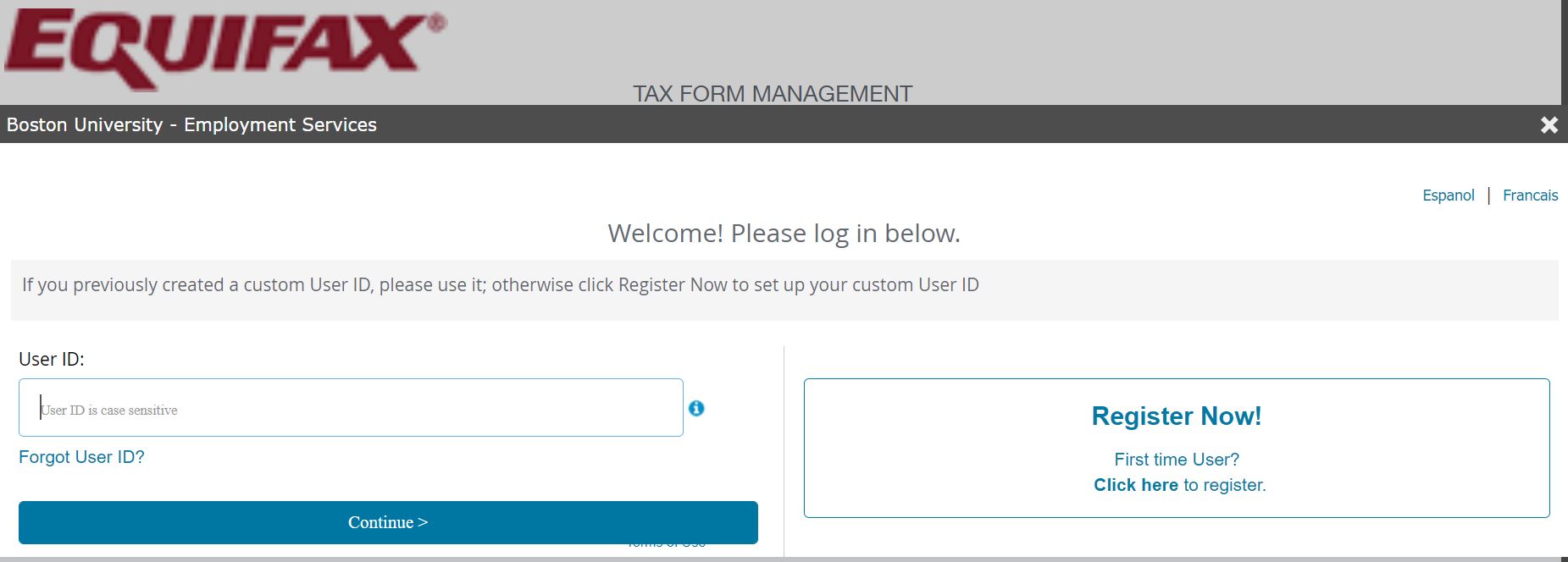

Www Uwlax Edu Globalassets Offices Services Human Resources 01 04 21 Electronic Only Distribution Of W 2 And 1095 C Forms Pdf

Form 1095 B Form 1095 C Note If the due date falls on any federal holiday, then the next business day will be the filing due date 3 ACA Form 1095B/C Electronic Filing Deadline Efiling is the easiest way to file Form 1095B/C with the IRS It saves a considerable sum that you spend on printing Form 1095C is sent out to those who enrolled in a health plan through the Health Insurance Marketplace In 21, you will be furnished with a Form 1095C reporting the information you need to know about the plan you enrolled in Further, as in prior years, this notice does not extend the date by which employers must file Forms 1094B/C and 1095B/C with the IRS That said, reporting entities must still file Forms 1094B/C and 1095B/C with the IRS by (as , falls on a Sunday) if filing by paper, and , if filing electronically

1095 C Employer Provided Health Insurance Irs Copy For 21 5098b Tf5098b

1095c

1095 c instructions 21 Make the most of a digital solution to develop, edit and sign contracts in PDF or Word format on the web Transform them into templates for multiple use, incorporate fillable fields to collect recipients? In the month of May, the IRS released a draft version of 1095C & 1095B These instructions are a helpful guide for mandatory ACA reporters who will need to incorporate these changes in their 22 ACA reporting Last year, the IRS mandated the reporting of ICHRA Coverage on Form 1095C by adding the new codes and lines Now, the IRS has released a draft version of 1095CRelated Forms 1095C Ever since mailing out a 1095C tax form was made compulsory in the 15 fiscal year, all ALEs are required to send these statements not only to their eligible employees but also to the IRS What are the Form 1095C deadlines?

1095 C Template Fill Online Printable Fillable Blank Pdffiller

What Is Form 1095 C Employer Provided Health Insurance Offer And Coverage Turbotax Tax Tips Videos

IRS Issues Draft Form 1095C / 1094C for ACA Reporting in 21 Click here to learn more about the changes in ACA FormsKnow your ACA reporting requirements for tax year and efile your ACA 1094/1095 Forms before the 21 deadline Avoid receiving ACA penalty letters and paying millions of dollars as penalties!

Irs Issues Draft Form 1095 C For Aca Reporting In 21

Changes In Irs Form 1095 C For Taxbandits Youtube

Choosing An Aca Provider Steele

Irs Govform1095a Employer Provided Health Insurance Offer In Pdf

1095 C Form 21 Irs Forms

Free Small Business And Hr Compliance Calendar February 21 Workest

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

Online Delivery Of W 2 Statement And Form 1095 C

2

21 Aca Form 1095 C Line 14 16 Code Sheet By Acawise Issuu

Vehi Org Client Media Files Ale Webinar Presentation Part Ii Examples10 3 18 Pdf

Irs Drafts Of New 16 Forms 1095 C 1094 C Leavitt Group News Publications

Your 1095 C Tax Form For Human Resources

How To Update Mailing Preferences On Your Tax Related Form Chapman Newsroom

Form 1095 C Guide For Employees Contact Us

What Is The Irs 1095 C Form Miami University

Irs Distribution Deadline March 2 21 Aca Gps

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Irs Form 1095 C Instructions For 21 Step By Step Filing Guide

Irs Issues Draft Form 1095 C For 21 Aca Reporting

Propel Hr The Deadline For Applicable Employers To Distribute Form 1095 C To Employees For The Tax Year Is March 2 21 Mypropelpro Com 2msdv9b Facebook

What Is A Tax Form 1095 A And How Do I Use It Stride Blog

Ty Draft Forms 1095 C And 1094 C Released Along With New Form 1095 C Codes Press Posts

15 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

Mn Gov Mmb Stat Segip Doc 1095 C Faq Pdf

Aca Code Cheatsheet

Cpi Hr Legal Alert Irs Extends Deadline For Furnishing Form 1095 C To Employees Facebook

Aca Deadlines Penalties Extension For 21 Checkmark Blog

Finally Some Good News California S Franchise Tax Board Delays Individual Mandate Reporting And Disclosure Deadlines

Form 1095 A 1095 B 1095 C And Instructions

Aca And The Vista Hrms Fall Update

Us Employers Now May Have To Comply With Aca Like Reporting Requirements By Individual Us State Integrity Data

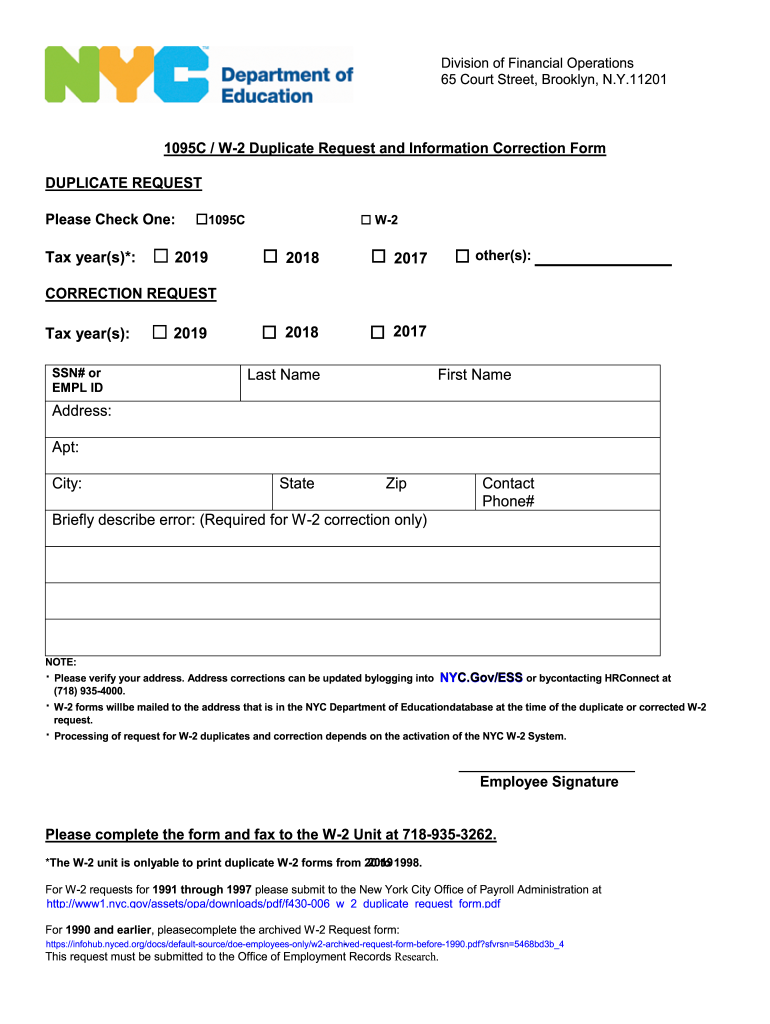

Ny 1095c W 2 Duplicate Request And Information Correction Form 19 21 Fill Out Tax Template Online Us Legal Forms

Form 1095 A 1095 B 1095 C And Instructions

1095 C 1094 C Aca Software To Create Print E File Irs Form 1095 C

1095 C Submit Your 1095 C Form Onlinefiletaxes Com

Draft 21 Aca Reporting Forms Issued By Irs The Aca Times

Dqyybrehdv2hxm

2

1095 C Form Official Irs Version Discount Tax Forms

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

Your 1095 C Tax Form For Human Resources

/1095b-741f9631132347ab8f1d83647278c783.jpg)

Form 1095 B Health Coverage Definition

Irs Form 1095 C Fauquier County Va

Best 1095 C Envelopes Of July 21 Romance University

Irs Extends Distribution Time Limit For Form 1095 Anderson Jones

Irs 1095 C 21 Fill Out Tax Template Online Us Legal Forms

Irs Form 1095 C Uva Hr

Hr Updates Theu

Form 1094 C And Form 1095 C B Benchmark Planning Group

How To Correct Form 1094 1095 Errors The Cip Group

New Tax Forms For Fehb Enrollees Forms 1095

Changes Coming For 1095 C Form Tango Health Tango Health

What Is The Irs 1095 C Form Miami University

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

New Form 1095 C Draft Issued By Irs For Filing In 22 Bernieportal

Irs Issues Draft Form 1095 C For Aca Reporting In 21

1095 C Sample Hcm 401 K Human Resources

E File Your Aca Form 1095 B C By March 31 21 In 21 Filing Taxes Form Irs

2

Employer Reporting Forms 1094 C And 1095 C Hays Companies

1

Changes Coming For 1095 C Form Tango Health Tango Health

Irs 1095 C Form Pdffiller

Jrw Associates Aca Reporting Reminder Employers Need To Furnish Form 1095 C To Their Full Time Employees By March 2 21 Facebook

Deadlines Ahead As Employers Prep For Aca Reporting In 21

Benefits Vmware Com Wp Content Uploads 21 01 Form 1095c Faq 21 Pdf

3

Irs Form 1095 C Instructions For 21 Step By Step Filing Guide

What Is Form 1095 C Acawise Youtube

Form 1095 C H R Block

Affordable Care Act Aca Ability To Generate 1095 B And 1095 C Forms Microsoft Dynamics Ax Community

Updated Hr S Guide To Filing And Distributing 1095 Cs Bernieportal

Irs Form 1095 C Codes Explained Integrity Data

1095 C Print Mail s

Irs Extends Deadline For Furnishing Form 1095 C To Employees Extends Good Faith Transition Relief For The Final Time Hmk

Updates To Form 1095 C For Filing In 21 Youtube

New Tax Forms For Fehb Enrollees Forms 1095

7 Must Know 21 Hr Compliance Dates Workest

Annual Health Care Coverage Statements

0 件のコメント:

コメントを投稿